Importing your data to SQLWorks

importing –

If you’re new to SQLWorks, importing your existing data to SQLWorks can seem daunting. Fear not! We’ve prepared this handy guide to make this process easier.

Decisions about your data are yours – but at any stage, you can ask the SQLWorks Team for help.

About Your Data

Data imported into SQLWorks is categorised in two types: Static and Transactional.

Static data is fixed lists of ‘things’ – including companies, contacts, address, your stock list, warehouses and more. Transactional data includes list of transactions, stock movements and financial ledger entries like orders, invoices, credit notes and more. Static data must be imported first, followed by transactional data.

Finding Your Data

Both your static and transactional data comes from whichever system(s) you use currently – this could mean importing from a number of sources, including:

- An old software program (e.g.: Sage)

- A patchwork of spreadsheets (e.g.: Microsoft Excel)

- A legacy database program or file (odbc compatible)

- Nowhere (because you’re a new or paper-based company)

- Some combination of the above

It’s up to you what data you place in SQLWorks, however whilst some data is almost always needed SQLWorks (even if entered new), other data is optional. As a rule, names, codes, accounting and VAT entries will need to be imported, but the optional parts of how your business model works (e.g.: records of quotes, or past stock movements) are optional.

How To Import:

All data for importing into SQLWorks needs to be given to the SQLWorks team in one of two formats:

- An agreed file format exported from another software (e.g.: Sage export file)

- A comma or tab delimited spreadsheet, .CSV or .TXT file. (e.g.: If using Excel, it is helpful to save the files as a .CSV in the ‘save as’ menu)

If you provide data to the SQLWorks team in spreadsheets (or .CSV/.TXT files) these will need column headings grouping certain types of the data together. For example, in a stock list, all your stock codes need to be in the same column, under an identifiable heading such as ‘Stock Code.’ The SQLWorks team can help you with this stage if you get stuck.

Depending on what SQLWorks modules you will be using, you will need to import files for the following data (see table below). Compulsory data within these are marked – for example: every Company imported must have a name.

SQLWorks Core |

CRM |

ACCOUNTS |

STOCK |

|

| Static | Companies

Contacts

Addresses

|

Sales Accounts

Purchase Accounts

Nominal Codes

|

||

| Transactional |

Outstanding Sales Orders

Outstanding Purchase Orders

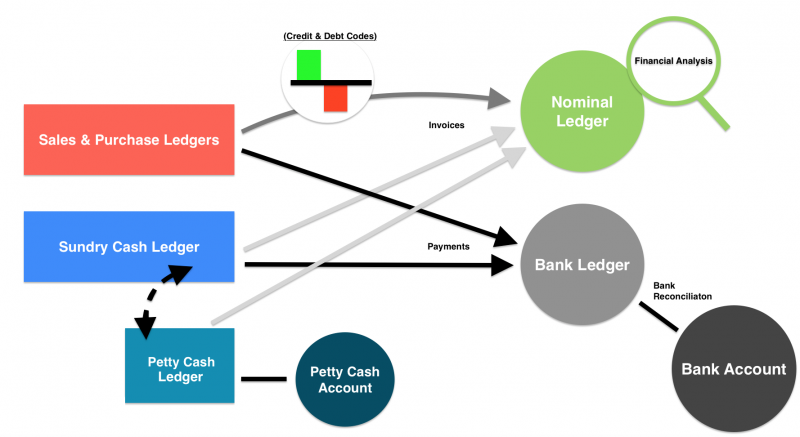

Outstanding Sales Invoices

Outstanding Purchase Invoices

Bank Rec

1 Bank Account

1 Petty Cash Account

|

|||

| Optional Static |

|

Sales Leads

Projects

|

Nominal Departments

Nominal Analysis Codes

Nominal Subheadings

Budgets

|

Warehouses

Stock List

Warehouse Bins

|

| Optional Transactional |

Tasks

Phone Logs

Actions

Emails |

Historic Sales Quotes

Historic Purchase Quotes

Historic Sales Orders

Historic Purchase Orders

Historic Sales Invoices / Receipts / Credit Notes

Historic Purchase Invoices / Payments / Credit Notes

Purchase Invoices (Historic) |

Stock Movements

|