Understanding Ledgers

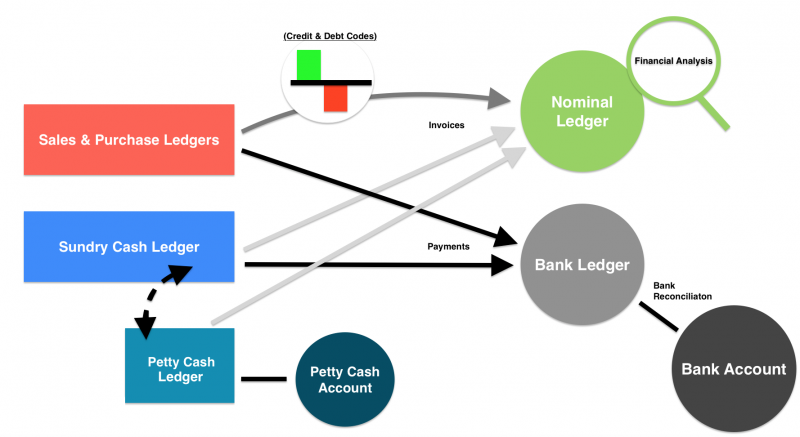

SQLWorks includes four main ledgers for customer transactions: Sales Ledger, Purchase Ledger, Sundry Cash Ledger and Petty Cash Ledger

For accounting, these transaction ledgers are collated into two analysis ledgers, your live Nominal Ledger and your Bank Ledger as described below.

Transaction Ledgers (Sales/Purchase/Sundry Cash/Petty Cash)

Your Sales and Purchase Ledgers control account centric transactions for selling and buying to a particular customer/supplier, typically involving an ordering process and a separated invoicing and payment process (i.e. debt and credit).

Sundry Cash Ledger is for payments to and from those whom you have no ‘account’ with, and therefore is best suited to financial transactions that have no delay in payment (for example, a simple cash sale). Because of this, your Sundry Cash Ledger should be used for direct sales & expenditure, or for moving funds into and out of your Petty Cash Ledger.

Each record in any transaction ledger will appear automatically in your nominal audit. SQLWorks follows standard double entry bookkeeping rules, in that each financial transaction has two associated nominal postings. When running a nominal audit SQLWorks uses your nominal profile in preferences and the list below to automatically generate the audit records from the records in the transaction ledgers:

| Financial Transaction Type | Side 1 Posts to: | Side 2 Posts to: |

| SL Invoice | Invoice Line Nominal Code | Creditor Account |

| SL Credit Note | Credit Line Nominal Code | Creditor Account |

| SL VAT | Creditors VAT Control Code | Creditor Account |

| SL Receipt | Bank Account Nominal Code | Creditor Account |

| SL Currency Variation | Variance Control Code | Creditor Account |

| SL Settlement | Settlement Control Code | Creditor Account |

| PL Invoice | Invoice Line Nominal Code | Debtor Account |

| PL Credit Note | Credit Line Nominal Code | Debtor Account |

| PL VAT | Debtors VAT Control Code | Debtor Account |

| PL Payment | Bank Account Nominal Code | Debtor Account |

| PL Currency Variation | Variance Control Code | Debtor Account |

| PL Settlement | Settlement Control Code | Debtor Account |

| Cash Book | Cash Record Nominal Code | Bank Account Nominal Code |

| Cash Book Income VAT | Creditors VAT Control Code | Bank Account Nominal Code |

| Cash Book Expense VAT | Debtors VAT Control Code | Bank Account Nominal Code |

| Petty Cash | Petty Record Nominal Code | Petty Account Nominal Code |

| Petty Cash Income VAT | Creditors VAT Control Code | Petty Account Nominal Code |

| Cash Book Expense VAT | Debtors VAT Control Code | Petty Account Nominal Code |

Bank Ledger

Your Bank Ledger records the actual record of payments and receipts. A payment can be exist in any of your three main transaction Ledgers (Sales/Purchase/Sundry Cash). Here you can group and organise payments into deposits to exactly match your Bank statement during the bank reconciliation process.

Your Bank Ledger can include multiple bank accounts, against which to record different types of payments. Each account must have a different nominal code that is used when automatically posting the payment records from SL, PL & SCL in the nominal ledger. Note that you cannot enter a payment/receipt record in SL, PL or SCL without selecting the bank account first.

Nominal Ledger

Whilst your Bank Ledger records the actual movement of funds, your Nominal Ledger also considers debit and credit transactions from the invoices in your Sales/Purchase Ledgers. The Nominal Ledger gives you a constantly updated window into the profit and loss for each part of your business. By using the ‘audit by year’ you take a snapshot of your business from which you can view P&L, Balance sheet, Trial Balance and drill down into actual live data.

Your Nominal Ledger audit pulls live data from the all of the financial transactions in your Sales and Purchase Ledgers, and from all of the records in Sundry Cash Ledger and Petty Cash Ledger. The value is posted to the nominal code stored on the record and the other side of the nominal posting is decided automatically as explained above, VAT is also posted automatically to the VAT control account.

The nominal ledger also loads nominal journals, non-financial records that serve only to move figures between nominal accounts. Certain processes in SQLWorks create journals automatically, such as end of year appropriation and changes that affect stock valuation.

The Nominal Ledger can have up to three tiers: Nominal codes, Analysis codes (i.e. Sub Nominal codes), and Department codes, each of which can be crosschecked against another to breakdown spending or revenue in different segments of your business for more targeted analysis. The nominal audit creates a record of the value against each individual combination and then pools together the data as per your reporting requirements.

Your Nominal Ledger provides an understanding of your accounts, which includes amounts owed and owing as well as gained or lost, for financial analysis.