Banking

SQLWorks includes a Banking Ledger to your record and plan all financial interactions with your bank accounts, monitor your statements and reconcile transactions.

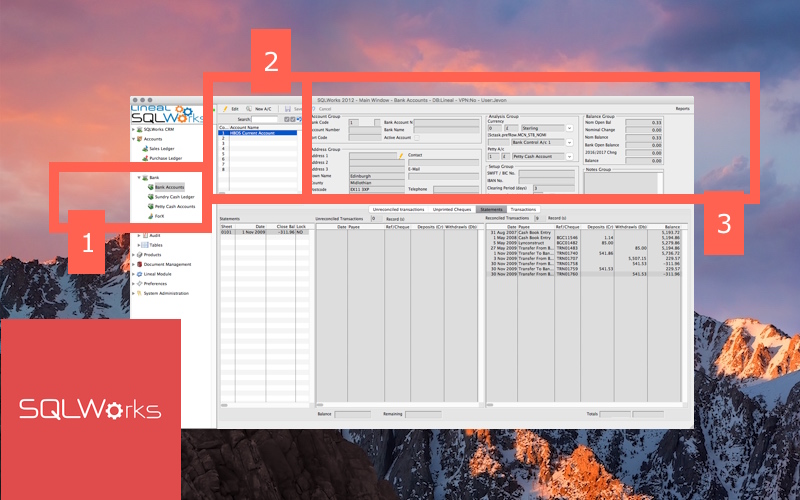

Bank Accounts can be found under the ‘Bank’ button within ‘Accounts’ (1) and your bank accounts are displayed in the top left (2) – with the details of the selected account (including branch address, account numbers, sort code, balances and currency) all shown on the top panel. (3) From the Bank section you can also access your ‘Sundry Cash Ledger’ (for cash accounting), ‘Petty Cash Accounts’ and Foreign Exchange data (under ‘ForX.’)

Your unreconciled transactions are displayed under the main ‘Unreconciled transactions’ tab in date order. To reconcile, move to the ‘Statements’ tab, select a statement, and double click on an unreconciled item to set it as reconciled (or vice versa)

If you use printed cheques as a part of your business, you can access your unprinted cheques via the ‘Unprinted Cheques’ tab, which can be used in conjunction with a cheque printing machine or dot matrix printer.

Should you need to add a new bank account for your business, you can do so from the top toolbar by clicking the ‘Add A/C’ button. Each new Bank Account will require a unique Nominal Ledger code for that account and a currency chosen from your list of default currencies.

Your new account can be set as the default bank account in Accounts Preferences by saving its number in the ‘Default Bank Account’ field under the ‘Finance’ Tab. SQLWorks should normally be used to treat Credit Cards as bank accounts, with statements processed in a similar manner.

SQLWorks is designed to keep your banking as transparent as possible, and ensure that it’s always easy to match up the contents of your bank ledger to your real world finances.

For accounting software that matches your business: speak to us about SQLWorks today.