Making Tax Digital with SQLWorks

Making Tax Digital

with SQLWorks Accounting

Officially Recognised by HMRC for Making Tax Digital

✅ Submit VAT Digitally

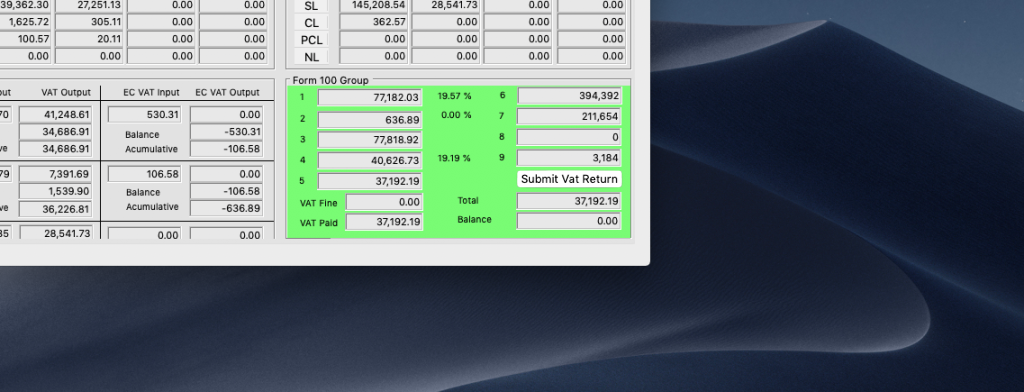

SQLWorks Accounting allows businesses and organisations to submit their VAT return to HMRC, digitally, instantly, and without any manual re-keying of data required.

- Simply connect your HMRC Account to SQLWorks Accounting, and you’re ready to get started. SQLWorks accurately compiles your VAT obligations from your invoicing automatically, populating your Form 100 boxes within the VAT Ledger, and ensuring your quarterly submission is both simple and convenient.

✅ Integrate with HMRC

Integrating directly via HMRC’s API, your SQLWorks VAT ledger can also be used for other common HMRC VAT tasks.

Each VAT quarter is automatically locked once submitted, and Accounts Admins have access to a wide range of HMRC’s VAT data for your company – within SQLWorks, including:

- VAT Obligations

- VAT Payments

- VAT Liabilities

- SQLWorks/HMRC Communication Logs

SQLWorks Accounting MTD tools support different VAT rates, for both quarterly and monthly submission, and both Standard and Cash Accounting companies.

✅ Much more to discover…

SQLWorks delivers a fully integrated business platform for small to medium sized businesses, including:

- Accounting

- CRM

- Stock Control, Warehousing & Inventory

- Order Processing

- Manufacturing & MRP

- Advanced Reporting

Click here to learn more about what SQLWorks can do for your business.

Have a question?

Making Tax Digital is a compulsory requirement for all VAT registered UK businesses. Speak to one of our team, today: