SQLWorks to Make Tax Digital

**NEW Update**

We’re Officially Recognised by HMRC for Making Tax Digital!

SQLWorks Accounting was approved for five key functionalities following demonstration of a sandbox environment to HMRCs review team. Learn more about Making Tax Digital with SQLWorks here.

|

We’ve updated our SQLWorks software to support Making Tax Digital – with Lineal staff officially demonstrating their work to HMRC’s Review Team during January 2019.

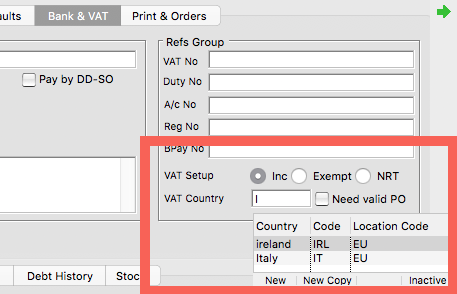

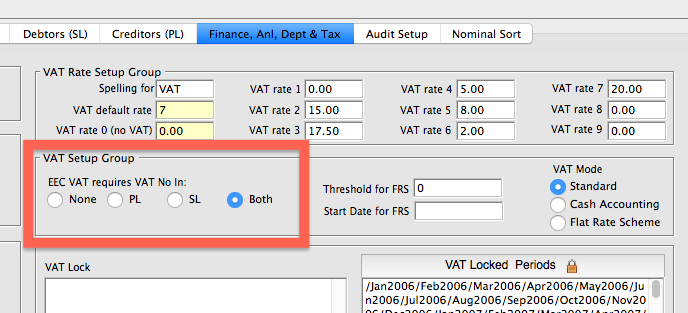

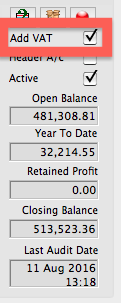

SQLWorks Accounts Prefs can be linked directly with a company’s HMRC VAT Account, granting permission to submit quarterly VAT returns for 18-months before re-authentication is required.

Making Tax Digital will be available for all SQLWorks Accounts Admin users via the existing VAT Ledger, and allows the accounts administrator to report their VAT return (shown in boxes 1-9) directly to HMRC’s system at the press of a button.

SQLWorks can also report up-to-date VAT account status information (such as obligation, payment and liability entries) from a company’s HMRC account, and access logs recording the full audit trail of communication between HMRC and our software. Once submitted, the company’s VAT return quarter is locked down to ensure security of reporting.

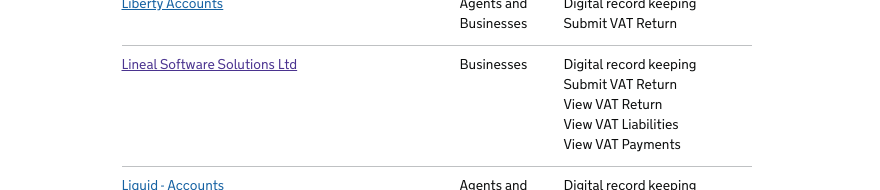

Lineal Software Solutions have been officially registered as a provider developing software suitable for HMRC’s new ‘Making Tax Digital’ initiative.

The new tax regulation, which will require UK businesses to undertake tax reporting (initially VAT) via digital links from April 2019, will need approved accounting software to report directly and digitally to a company’s HMRC digital tax account via web API.

Only software which passes a reporting test set by HMRC using example data will be approved for Making Tax Digital (Phase 2 standard.)

Mike Matthews explained: “Currently only around 130 software providers in the UK are registered as developing for direct Making Tax Digital accounts reporting. SQLWorks has had the ability to calculate your VAT return for many years, but very soon, you’ll be able to process your submission direct to HMRC digitally too.”

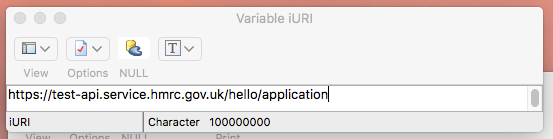

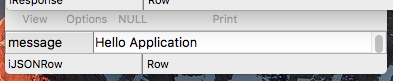

HMRC says a quick Hello to SQLWorks during testing…

“HMRC’s main aim is to remove any re-keying or manual re-processing of data – which will make SQLWorks the perfect integrated solution for processing business all the way from quotation to sale, to direct VAT reporting.”

“The government have recently altered some of the software rules being put into place for making tax digital, but we’re hard at work to make sure all SQLWorks customers can begin reporting VAT digitally from next year.”

Recent figures collected by The Institute for Chartered Accountants have suggested awareness of Making Tax Digital is still very limited, with less than half of businesses stating they were unaware of changes that are about to come into force.

This Page will be updated periodically with the latest SQLWorks Making Tax Digital news – please check back for updates! 30.10.18

For an effective, integrated software solution – contact our team today.