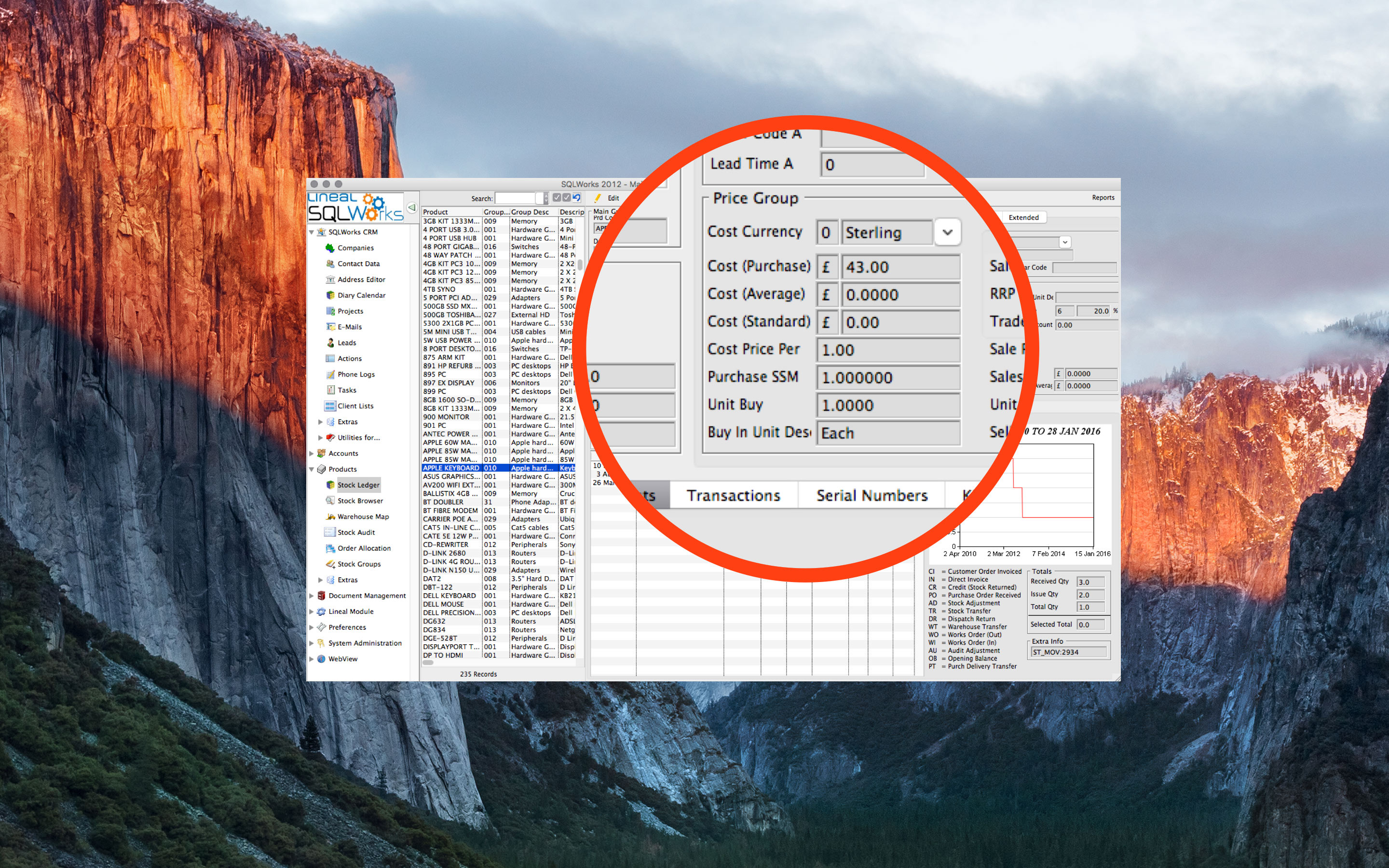

Stock comes in many different forms, so SQLWorks stock ledger can be set to value stock, per item, in four different ways – known as stock costs:

- Default Purchase Cost – specify a purchase cost against any stock item in any currency, and when you buy in that currency, SQLWorks will match the costs using the appropriate exchange rate.

- Average Cost – this is an average taken across all purchase invoices over the total quantity of stock. Accurate to up to 4 decimal places, this can be recalculated with a right click or set to automatically update via Preferences > Accounts Prefs > Stock. If no stock is available average cost will estimate an average from recent sold stock using your invoices.

- Standard Cost – Your custom valuation, not derived from any financial transactions in the system, and used to give a stock item an arbitrary value.

- Batch Cost – Used for advanced warehousing, batch cost records the cost of each item from a specific purchased batch, and can vary between batches, allowing for more accurate manufacturing, re-sale and accounting.

On costs/landed costs, accounting for extra stock costs obtained with freight charges, duties and import taxes, can also be recorded specifically or as averages, and users can specify whether to include or exclude on-costs from their stock valuations.

When generating reports in SQLWorks, users can specify the default valuation for your stock from among the stock cost methods, choosing the one most appropriate for your business. By setting a default cost type, this also affects your Sales Ledger, directly affecting profit and associate reports.

Learn more about SQLWorks stock today: http://www.sqlworks.co.uk/stock/